Retire with Confidence

Plan now for the income and protection needed for your joy in retirement

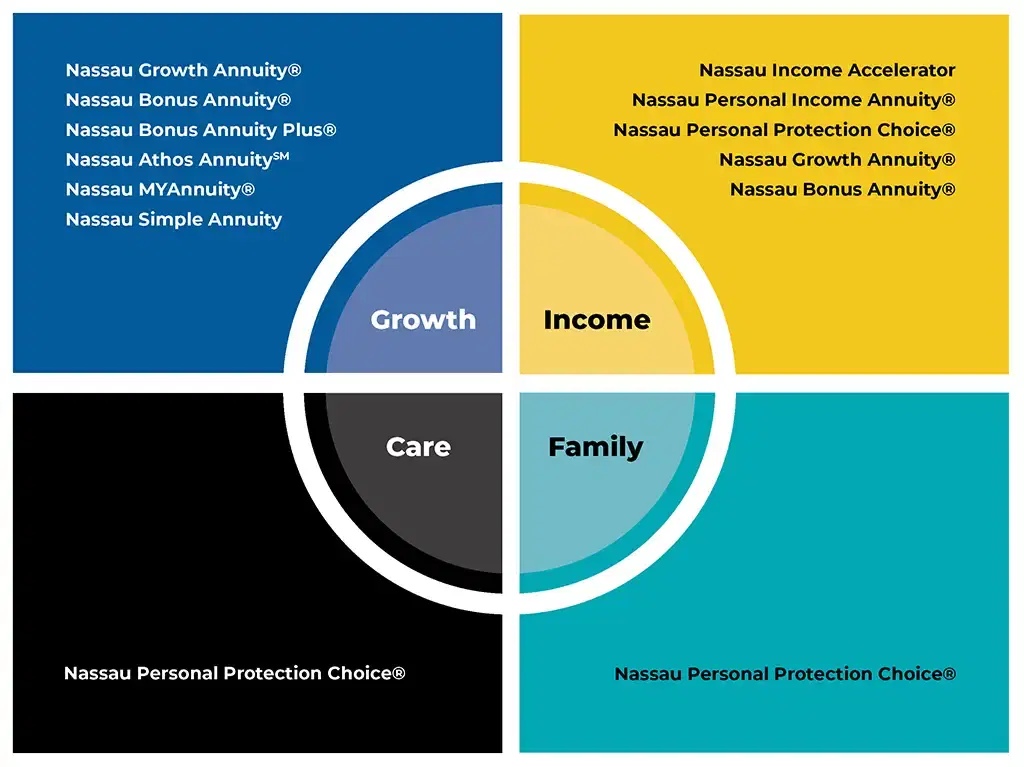

Our Annuity Offerings

We are committed to providing comprehensive, customizable and consistent retirement solutions.

Discover the Indices That Power Our Fixed Indexed Annuities

Nassau Athos AnnuitySM

Help retirement savings climb with the next generation of growth strategies. Nassau Athos Annuity is an accumulation-focused fixed indexed annuity. It offers strong growth potential through index accounts that can be extended to capture multi-year market upside while providing powerful protection, flexibility and control over your retirement savings. Athos also includes a guaranteed, upfront premium bonus to help jump start your savings.

![Nassau Athos Annuity,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fathos-product-square.webp&w=3840&q=75)

![Nassau Athos Annuity,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fathos-product-square.webp&w=3840&q=75)

Nassau Athos AnnuitySM

Help retirement savings climb with the next generation of growth strategies. Nassau Athos Annuity is an accumulation-focused fixed indexed annuity. It offers strong growth potential through index accounts that can be extended to capture multi-year market upside while providing powerful protection, flexibility and control over your retirement savings. Athos also includes a guaranteed, upfront premium bonus to help jump start your savings.

Nassau Bonus Annuity Plus®

Nassau Bonus Annuity Plus® is a single premium accumulation-focused fixed indexed annuity. Nassau Bonus Annuity Plus helps increase retirement savings with our highest premium bonus and competitive total accumulation potential. It provides enhanced control over the contract’s accumulation value by offering an annual free withdrawal that can rise each year if no withdrawals are taken. It also contains powerful, tax-deferred growth potential to help contract holders catch up or get a head start on their nest eggs — all while helping to protect the principal from market losses. An annual enhanced benefit fee applies during the first 10 contract years.

![Nassau Bonus Annuity Plus,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fnba-plus-product-square.webp&w=3840&q=75)

Nassau Bonus Annuity Plus®

Nassau Bonus Annuity Plus® is a single premium accumulation-focused fixed indexed annuity. Nassau Bonus Annuity Plus helps increase retirement savings with our highest premium bonus and competitive total accumulation potential. It provides enhanced control over the contract’s accumulation value by offering an annual free withdrawal that can rise each year if no withdrawals are taken. It also contains powerful, tax-deferred growth potential to help contract holders catch up or get a head start on their nest eggs — all while helping to protect the principal from market losses. An annual enhanced benefit fee applies during the first 10 contract years.

![Nassau Bonus Annuity Plus,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fnba-plus-product-square.webp&w=3840&q=75)

Nassau Income Accelerator

Nassau Income Accelerator offers flexible guaranteed lifetime income options that can help you optimize your total retirement income before starting payments from other sources like Social Security, government or pension payouts. Nassau Income Accelerator is a single-premium fixed indexed annuity. It offers a choice of three guaranteed minimum withdrawal benefit riders: Flex-Forward Income BenefitSM, Income Horizon: Early and Income Horizon: Later. Flex-Forward Income Benefit can be tailored to your specific income needs by offering higher income payments early in exchange for lower income payments later. Income Horizon: Early and Income Horizon: Later both provide levelized guaranteed lifetime income to fit your unique income timeline.

Nassau Income Accelerator

Nassau Income Accelerator offers flexible guaranteed lifetime income options that can help you optimize your total retirement income before starting payments from other sources like Social Security, government or pension payouts. Nassau Income Accelerator is a single-premium fixed indexed annuity. It offers a choice of three guaranteed minimum withdrawal benefit riders: Flex-Forward Income BenefitSM, Income Horizon: Early and Income Horizon: Later. Flex-Forward Income Benefit can be tailored to your specific income needs by offering higher income payments early in exchange for lower income payments later. Income Horizon: Early and Income Horizon: Later both provide levelized guaranteed lifetime income to fit your unique income timeline.

Nassau Bonus AnnuitySM

Nassau Bonus AnnuitySM is a single premium accumulation-focused fixed indexed annuity with an upfront premium bonus, robust growth potential, and options for generating future income. Contract holders can jumpstart savings to either catch up or get a head start on their nest eggs, all while protecting potential growth from market losses. With the optional Amplified Income Plus and Amplified Income Plus with Rising Income Opportunity riders, clients can build on the contract growth to help boost potential income payments in retirement.

![Nassau Bonus Annuity,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fnba-product-square-image.jpg&w=3840&q=75)

Nassau Bonus AnnuitySM

Nassau Bonus AnnuitySM is a single premium accumulation-focused fixed indexed annuity with an upfront premium bonus, robust growth potential, and options for generating future income. Contract holders can jumpstart savings to either catch up or get a head start on their nest eggs, all while protecting potential growth from market losses. With the optional Amplified Income Plus and Amplified Income Plus with Rising Income Opportunity riders, clients can build on the contract growth to help boost potential income payments in retirement.

![Nassau Bonus Annuity,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fnba-product-square-image.jpg&w=3840&q=75)

Nassau Growth Annuity®

With Nassau Growth Annuity, a single premium accumulation-focused fixed indexed annuity with guaranteed lifetime withdrawal benefit options, individuals can build retirement savings and protect that growth from market losses. Additionally, with the Amplified Income, Amplified Income with Rising Income Opportunity, Amplified Income Plus, and Amplified Income Plus with Rising Income Opportunity rider options, clients can build on the contract growth to help boost potential income payments in retirement.

![Nassau Growth Annuity,[object Object]](/_next/image?url=%2F_next%2Fstatic%2Fmedia%2Fnga-image.368670d8.gif&w=3840&q=75)

![Nassau Growth Annuity,[object Object]](/_next/image?url=%2F_next%2Fstatic%2Fmedia%2Fnga-image.368670d8.gif&w=3840&q=75)

Nassau Growth Annuity®

With Nassau Growth Annuity, a single premium accumulation-focused fixed indexed annuity with guaranteed lifetime withdrawal benefit options, individuals can build retirement savings and protect that growth from market losses. Additionally, with the Amplified Income, Amplified Income with Rising Income Opportunity, Amplified Income Plus, and Amplified Income Plus with Rising Income Opportunity rider options, clients can build on the contract growth to help boost potential income payments in retirement.

Nassau Personal Income Annuity®

Retirement is a new adventure, but also a new challenge. You’ll need to know how much money you’ll need to live the life you want, and how to manage risks like market volatility, inflation and outliving your savings. With Personal Income Annuity, a single-premium deferred annuity, you can receive a guaranteed income for life, starting now or at a later date. You can also choose other flexible options to meet your specific needs and help you grow your contract value.

![Nassau Personal Income Annuity,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fpia-product-square-image.jpg&w=3840&q=75)

Nassau Personal Income Annuity®

Retirement is a new adventure, but also a new challenge. You’ll need to know how much money you’ll need to live the life you want, and how to manage risks like market volatility, inflation and outliving your savings. With Personal Income Annuity, a single-premium deferred annuity, you can receive a guaranteed income for life, starting now or at a later date. You can also choose other flexible options to meet your specific needs and help you grow your contract value.

![Nassau Personal Income Annuity,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fpia-product-square-image.jpg&w=3840&q=75)

Nassau Personal Protection Choice®

What will your retirement look like? You can picture yourself living your dreams, but also worry about some of life’s uncertainties. Your retirement plan should give you the flexibility to address your top concerns and choose the benefits most important to you. With Personal Protection Choice, a single-premium deferred annuity, you can choose benefits such as a guaranteed income stream, protection from unplanned health care costs, and features to meet other important financial goals like providing for your family

![Nassau Personal Protection Choice,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fppc-product-square-image.jpg&w=3840&q=75)

![Nassau Personal Protection Choice,[object Object]](/_next/image?url=https%3A%2F%2Fassets.nfg.com%2Fwebsite%2Fproducts%2Fppc-product-square-image.jpg&w=3840&q=75)

Nassau Personal Protection Choice®

What will your retirement look like? You can picture yourself living your dreams, but also worry about some of life’s uncertainties. Your retirement plan should give you the flexibility to address your top concerns and choose the benefits most important to you. With Personal Protection Choice, a single-premium deferred annuity, you can choose benefits such as a guaranteed income stream, protection from unplanned health care costs, and features to meet other important financial goals like providing for your family

Nassau MYAnnuity® 5X, 7X

Retirement means simplifying your life while maximizing your dreams. What's one way you may be able to accelerate your goals in today's low interest environment? Simple. A multi-year guaranteed annuity may provide you with protection, while securing your premium payment with higher return potential than many other fixed interest rate products in the marketplace. Nassau MYAnnnuity can be a simple solution to help you realize your retirement dreams. It is a single-premium, multi-year annuity that offers a choice of 5 or 7 year guarantee periods. Ready to add to your income with a locked-in-rate?

![Nassau MYAnnuity,[object Object], 5X, 7X](/_next/image?url=%2F_next%2Fstatic%2Fmedia%2Fmyga-product-square-image.d299c4d6.jpg&w=3840&q=75)

Nassau MYAnnuity® 5X, 7X

Retirement means simplifying your life while maximizing your dreams. What's one way you may be able to accelerate your goals in today's low interest environment? Simple. A multi-year guaranteed annuity may provide you with protection, while securing your premium payment with higher return potential than many other fixed interest rate products in the marketplace. Nassau MYAnnnuity can be a simple solution to help you realize your retirement dreams. It is a single-premium, multi-year annuity that offers a choice of 5 or 7 year guarantee periods. Ready to add to your income with a locked-in-rate?

![Nassau MYAnnuity,[object Object], 5X, 7X](/_next/image?url=%2F_next%2Fstatic%2Fmedia%2Fmyga-product-square-image.d299c4d6.jpg&w=3840&q=75)

Nassau Simple Annuity

Looking for predictable interest income in retirement? Simple. Apply for our multi-year guaranteed annuity directly on our website. A multi-year guaranteed annuity may provide you with protection from market volatility while providing a stable source of interest income. Nassau Simple Annuity may be part of a simple strategy to help you protect your retirement dreams. It is a single-premium, multi-year annuity that offers a choice of 4 or 6 year guarantee periods with a 5% annual free withdrawal benefit. Ready to add to your income with a locked-in-rate?

Nassau Simple Annuity

Looking for predictable interest income in retirement? Simple. Apply for our multi-year guaranteed annuity directly on our website. A multi-year guaranteed annuity may provide you with protection from market volatility while providing a stable source of interest income. Nassau Simple Annuity may be part of a simple strategy to help you protect your retirement dreams. It is a single-premium, multi-year annuity that offers a choice of 4 or 6 year guarantee periods with a 5% annual free withdrawal benefit. Ready to add to your income with a locked-in-rate?

Source: TrustPilot

Important Disclosures

This page is not intended for residents of Idaho or Illinois.

Nassau Life and Annuity Company, Nassau Income Accelerator and the Flex-Forward Income Benefit rider are NOT connected with, recommended, or endorsed by any governmental program, agency, or entity, including the Social Security Administration.

Tax references in this material are for informational purposes only and based upon current laws. This material is intended for general use with the public and is not meant to provide investment, tax or financial planning advice. Nassau does not provide individual tax, financial or investment advice or act as a fiduciary in the sale or service of insurance contracts. Please consult your personal tax or financial advisor for assistance. Nassau has a financial interest in the sale of its products. Please consult the applicable product and rider disclosures for a full description of features, benefits, and restrictions.

Product features, riders and availability may vary by state. Guarantees are based on the claims-paying ability of the issuing company. Guaranteed lifetime withdrawal benefit riders (if available) must be elected at issue and involve an additional fee that is deducted annually from your contract value. While the value of indexed accounts are affected by the value of an outside index, the contract does not directly participate in any stock, bond or equity investment.

These annuities offer a Fixed Account and a variety of Indexed Accounts. The Fixed Account may earn a specified rate of interest of 0% or greater. The Indexed Accounts may or may not earn Index Credits. Index Credits are credited if the type of Index that the Indexed Account tracks performs in a manner described in the Indexed Account riders attached to your contract. Although Index Credits are awarded based on index performance, these annuities are not securities. You are not buying shares of any stock or investing in an index. You are purchasing an annuity, which is a type of insurance contract issued by an insurance company. You can use an annuity to save money for retirement and to receive retirement income for life. It is not meant to be used to meet short-term financial goals.

Non-Security Status Disclosure - These contracts have not been approved or disapproved by the Securities and Exchange Commission. The contracts are not registered under the Securities Act of 1933 and are offered and sold in reliance on an exemption therein.

Nassau Athos Annuity (25FIA-XT, ICC25FIA-XT), Nassau Bonus Annuity Plus (23FIA4, ICC23FIA4), Nassau Income Accelerator (19FIA, ICC19EIAN, 19ISN, 19GLWB2, 22GLWB, 22GLWB1.1, 23GLWB2.1, ICC22GLWB1.1, ICC23GLWB2.1, et al.), Nassau Bonus Annuity (19FIA3, ICC19FIA3, 19GLWB3, ICC19GLWB3.1), Nassau Growth Annuity (19FIA3, ICC19FIA3N, 19GLWB3, ICC19GLWB3.1, 19ECH, ICC19ECH), Nassau Personal Income Annuity (19FIA, ICC19EIAN, 19ISN, 19GLWB2, ICC19GLWB2.1, ICC19GLWB2.2), and Nassau Personal Protection Choice (19FIA, ICC19EIAN, 19RN, 19GLWB2, 19GMDB-S.1, 19EWB, ICC19GLWB2.1, ICC20EWB.1, et al. ), single premium deferred fixed indexed annuities, and Nassau MYAnnuity 5X/7X (18IFDAP and ICC18IFDAP/ICC18IFDANP) and Nassau Simple Annuity (18FADTCP and ICC18FADTCP) single premium deferred fixed annuities are issued by Nassau Life and Annuity Company (Hartford, CT). In California, Nassau Life and Annuity Company does business as "Nassau Life and Annuity Insurance Company." Nassau Life and Annuity Company is not authorized to do business in ME and NY, but that is subject to change. In New York, Nassau MYAnnuity 5X (17IMGA) single premium deferred fixed annuities are issued by Nassau Life Insurance Company (East Greenbush, NY). Nassau Life and Annuity Company and Nassau Life Insurance Company are subsidiaries of Nassau Financial Group. The insurers are separate entities and each is responsible for its own financial condition and contractual obligations.

Insurance Products: Not FDIC or NCUAA Insured, No Bank or Credit Union Guarantee.

BPD40660e

10-25